Which Investors Drive Factor Returns?

If different investors share a common goal, why are there differences in strategy choices and portfolio characteristics across investor classes? Elsaify (2022) attempts to provide an answer. In his study, he documents heterogeneity in investors’ processing abilities, which is the key factor influencing investor’s strategy choice and finds that such heterogeneity stems from factor timing ability.

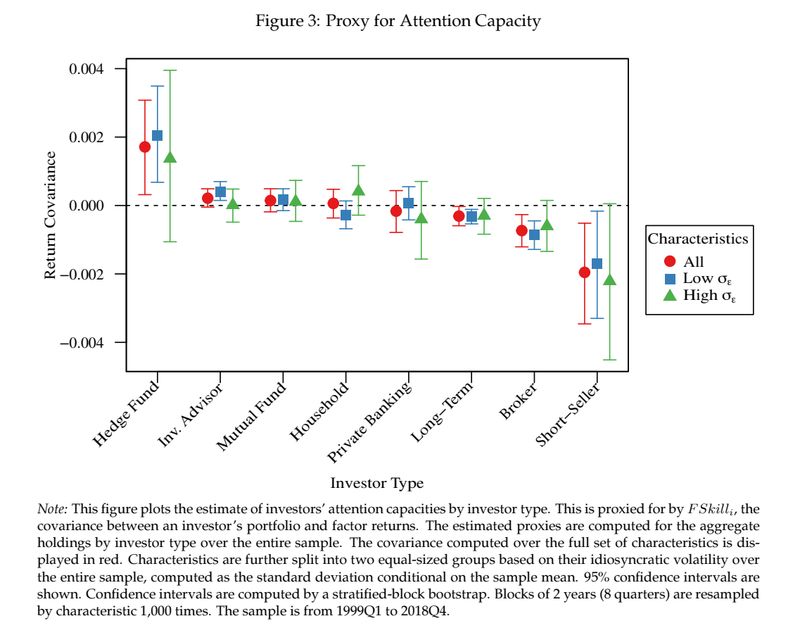

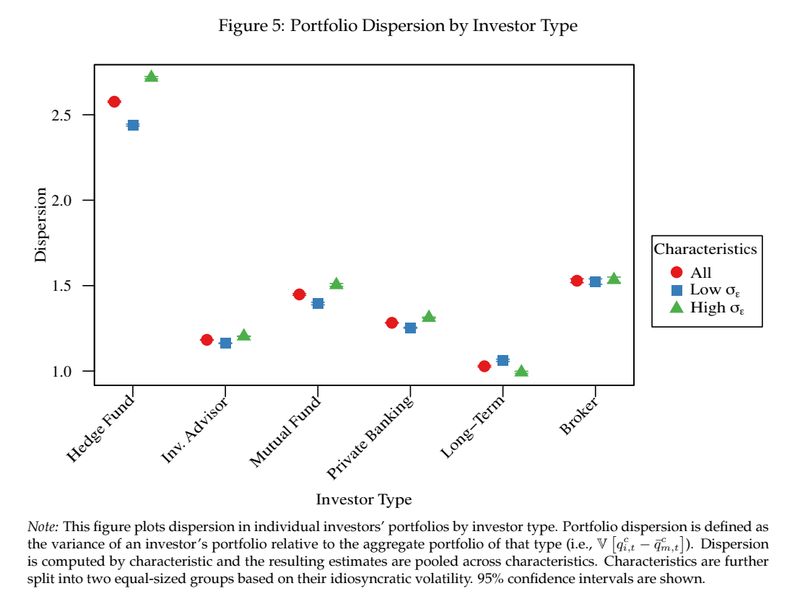

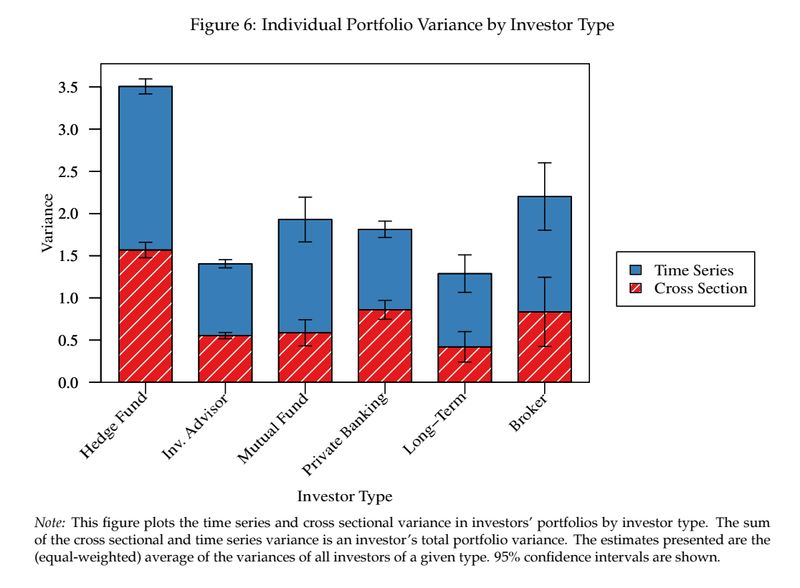

Elsaify (2022) first presents and then empirically supports a theoretical model of allocation problem, in which investors allocate their attention between “fundamental” and “idiosyncratic” component of an aggregate risk factor. Which component they give their relative attention to reflects whether they will pursue a factor selection or a factor timing strategy. While learning about fundamental (factor selection) is the focus of low capacity investors, investors with higher attention capacity zero in on learning about the idiosyncratic component (i.e. factor timing). Results of the study indicate that covariance between exposures and payoffs, portfolio dispersion and variance are all increasing in attention capacity. Furthermore, high capacity investors, i.e. investors with more precise price information, have greater impact on prices, increase price informativeness and thus reduce the volatility of factor returns.

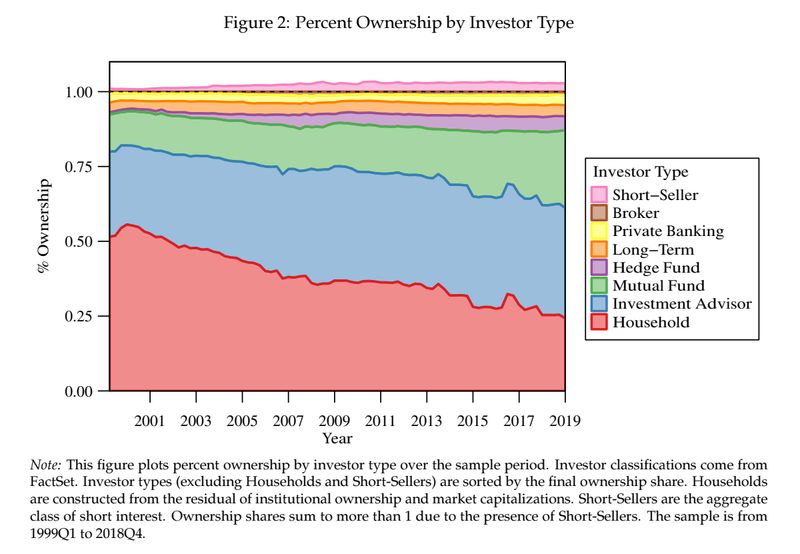

In summary, different investors are equipped with different information processing abilities, which leads to variability in optimal information choice and, subsequently results in heterogeneity in portfolio section. According to the results, hedge funds seem to have the highest attention capacity, the most precise information and excel at factor timing. Their portfolios appear to be the most dispersed as well as most volatile. Moreover, demand system approach shows they exhibit the greatest per-dollar impact on asset prices. On the other hand, long-term investors (insurance companies and pension funds), brokers, and short-sellers exhibit low attention capacity because of their timing inability. They spend relatively more attention on the fundamental, their portfolios have the least dispersion and variance and their impact on factor returns is limited.

Authors: Morad Elsaify

Title: Which Investors Drive Factor Returns?

Link: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4028206

Abstract:

Different investors hold different portfolios. To explain this phenomenon, I build a model in which investors have different information processing capabilities. The model predicts that highly capable investors specialize in factor timing, hold more volatile and dispersed portfolios, and reduce average risk premia and volatility. Using novel empirical measures of investors’ capabilities and information choices, I find that hedge funds are the most capable investors, while insurance companies and pension funds are the least. Variation in factor timing ability is the primary driver of these differences. Investors’ portfolios exhibit properties consistent with the model’s predictions. Using a demand system approach, I show that hedge funds have the greatest per-dollar impact on expected returns, shrinking expected returns in the factor zoo by nearly 40% per $1 trillion of invested capital.

Notable quotations from the academic research paper:

“I gather a set of 55 accounting and price variables that have been documented to predict returns cross sectionally and form a long-short portfolio for each. The resulting factor universe generates a panel that is sufficiently large to conduct meaningful time series and cross sectional tests.

There are T ≥ 2 periods beginning at t = 0. At t = 0, investors allocate attention across a set of shocks at all future dates. At each date t ≥ 1, investors receive a set of signals based on their information choice at t = 0 and make portfolio allocation decisions. All payoffs are realized at the end of period T.

The risk factor ft is driven by two components, both of which are unknown. The first—the “fundamental” component—is persistent across time, while the second—the “idiosyncratic” component—is independent of the fundamental and serially uncorrelated.

The idiosyncratic component is the transitory deviation of a factor payoff from its fundamental value. Uncertainty about the fundamental stems from the factor zoo; with hundreds of characteristics potentially associated with returns, there is uncertainty surrounding each factor’s average payoff.

An investor’s information choice depends on the uncertainty about the fundamental relative to uncertainty about the idiosyncratic component. When fundamental uncertainty is high, investors with more capacity allocate a greater fraction of their attention to learning about the idiosyncratic component. As investors use their information when making portfolio decisions, this implies that high capacity investors engage more in factor timing. Investors with less capacity, on the other hand, focus on learning about the fundamental, meaning they engage primarily in factor selection.

The dispersion and variance of an investor’s portfolio are driven by two competing effects. An investor with greater attention capacity receives more precise signals, reducing the variance and dispersion of her portfolio. However, as she is aware of the quality of her information, she updates and acts on her beliefs more aggressively. The latter effect dominates, meaning that portfolio dispersion and variance in both the time series and the cross section are increasing in attention capacity.

In the model, prices are endogenously determined as an aggregation of all investors’ beliefs. Investors’ weights in this aggregation are proportional to the quality of their information. As a result, investors with superior information have a greater impact on prices. This is true in the pricing of both the fundamental and idiosyncratic components. Further, the model allows me to examine the direction of this price impact. Investors with superior information increase price informativeness by bringing prices closer to the actual factor realizations. Investors with less precise information, on the other hand, reduce price informativeness by reducing the average quality of investors’ information.

Investors’ impact on price informativeness has implications for both risk premia and volatility. Increasing price informativeness shrinks expected returns towards zero. This is because high capacity investors act as arbitrageurs by bringing prices closer to their fundamental values. The same logic applies to the idiosyncratic component. An increase in price informativeness brings prices closer to a factor’s idiosyncratic realization at each point in time. As a result, high capacity investors also reduce the volatility of factor returns.

An investor type’s importance in price setting is driven solely by attention capacity. This affects prices in two ways. First, a group of investors with greater attention capacity holds portfolios that deviate more significantly from the market portfolio. As a result, switching to the market portfolio would have a drastic impact on prices. Second, if those investors received very high quality signals, then, in their absence, the average information quality in the market falls, leading to a greater impact on prices.”

Are you looking for more strategies to read about? Sign up for our newsletter or visit our Blog or Screener.

Do you want to learn more about Quantpedia Premium service? Check how Quantpedia works, our mission and Premium pricing offer.

Do you want to learn more about Quantpedia Pro service? Check its description, watch videos, review reporting capabilities and visit our pricing offer.

Or follow us on:

Facebook Group, Facebook Page, Twitter, Linkedin, Medium or Youtube